How to Raise Your Credit Score by 100 Points in 3 Months: The Ultimate 2026 Guide

Is it really possible to raise your credit score by 100 points in just 90 days? Many people deem it impossible, but as financial experts know, nothing is impossible in credit repair if you have the right strategy.

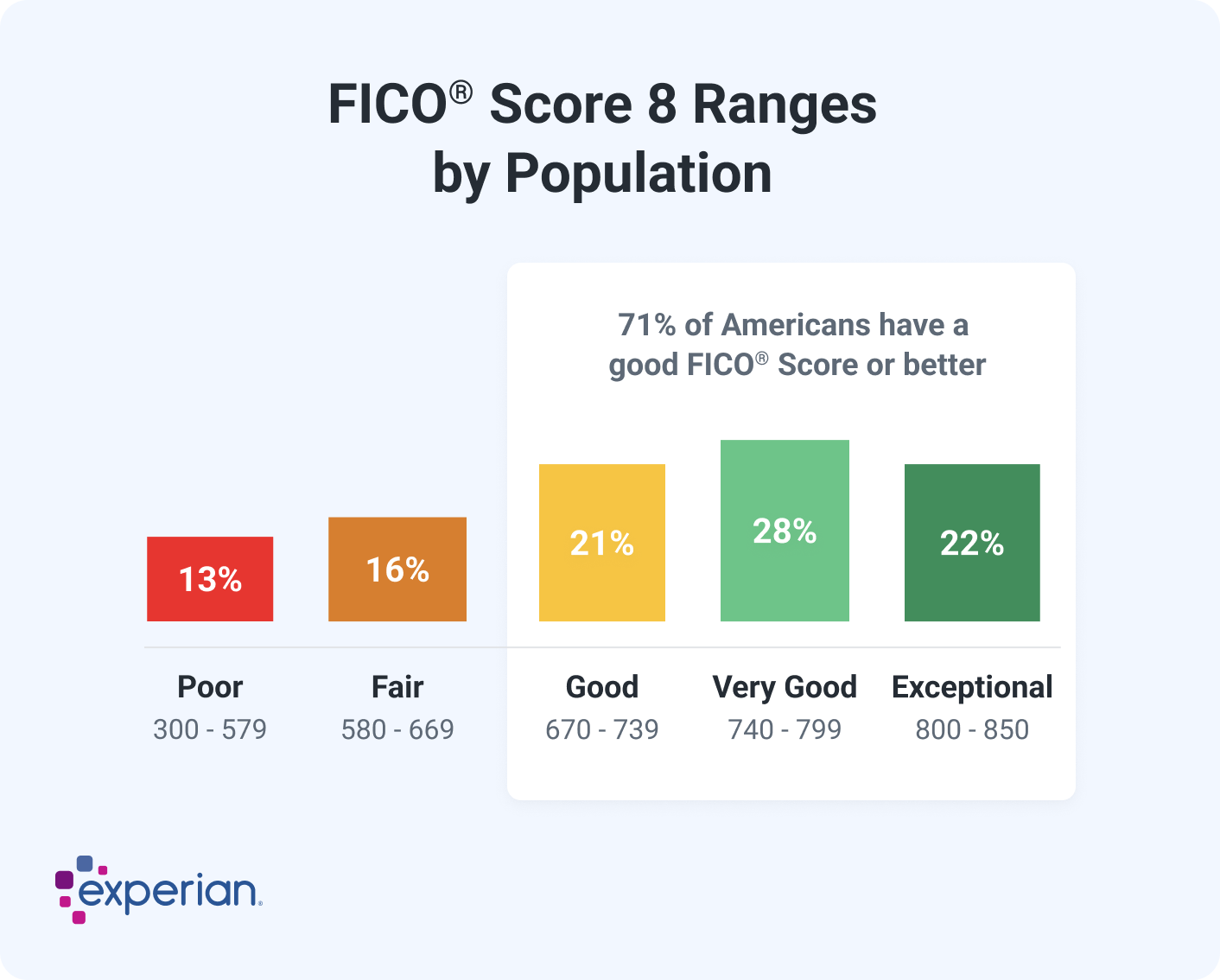

In 2026, with interest rates on mortgages and auto loans remaining high, having a "Good" to "Excellent" credit score (720+) can save you thousands of dollars. Whether you are planning to buy a home or refinance a car, boosting your score is the best investment you can make.

Here is a step-by-step blueprint to fast-track your credit repair journey.

Step 1: Know Your Starting Point (The Audit)

You cannot fix what you do not measure. Start by pulling your free credit reports from the three major bureaus: Experian, Equifax, and TransUnion.

Look for errors. In 2026, studies show that nearly 20% of credit reports contain mistakes. If you find an account that isn't yours or a payment marked late that was actually on time, dispute it immediately. Removing a single error can boost your score by 20-50 points overnight.

Step 2: Pay Down Credit Card Balances (Utilization Hack)

The fastest way to move the needle is by lowering your Credit Utilization Ratio. This accounts for 30% of your FICO score.

- The Rule: Never use more than 30% of your limit.

- The Hack: To see a 100-point jump, pay your balances down to below 10%.

Example: If you have a $1,000 limit, ensure your balance is never more than $100 when the statement closes.

Step 3: The "Pay for Delete" Strategy for Collections

There have been cases of people paying off collections, yet the negative mark remains on their report for 7 years. This is a common mistake.

Do not just pay a collection agency. Instead, negotiate a "Pay for Delete" agreement. Tell them: "I will pay the full amount right now if you agree to remove this account from my credit report entirely." Get this in writing. If they delete it, your score will skyrocket.

Step 4: Rectify Late Payments

Many people get carried away and have lapses in paying bills. That’s okay; you just have to rectify it in time. Payment history is 35% of your score.

If you have a recent late payment, call the creditor and ask for a "Goodwill Adjustment." If you have been a loyal customer otherwise, they may agree to erase the late mark as a one-time courtesy.

Step 5: Do Not Close Old Accounts

This is very necessary. When you pay off a credit card, you might feel the urge to close it. Don't do it.

Closing an account hurts you in two ways:

- It shortens your Average Age of Credit (15% of your score).

- It reduces your total available credit, which spikes your utilization rate.

Keep the account open and buy a small item (like a coffee) once every 3 months to keep it active.

Bonus Tip: Become an Authorized User

If you have a family member with excellent credit and a long history, ask them to add you as an Authorized User on one of their oldest credit cards. Their good history will get "copied" onto your report, potentially giving you a massive boost instantly.

Conclusion

Raising your credit score by 100 points in 3 months requires discipline, but the path is clear. Follow up on these steps, ensure you do not leave anything lagging, and watch your financial doors open.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Credit scores vary by individual profiles. Consult a certified credit counselor for personalized assistance.